As you know by now, I spend time working with VCs, preparing companies to engage with them, advising on how best to understand their business models, their motivations, and their value-add to a new idea or business.

Venture capital is a fairly well-worn path, with well-established rules, cultural conventions (including a measure of bowing and scraping), even traditions. Sand Hill Road is a destination not unlike the Vatican or the Great Wall of China. Until now, VC money has called the tune, being the short commodity in the overall entrepreneurial picture.

But times are changing, and rather quickly.

At least in the States (where VC was founded and still accounts for 80% of world-wide investment from the sector), there’s plenty of money. Individual funds are increasingly hard-pressed to find the best deals – and convince the founders that accepting money from their fund is the quickest path to company success. Which means competitions between funds that result in higher valuations and bigger risks. And increased pressure on the funds, which means killing companies that fail to stand up and dance as projected at an even faster clip. We’ve talked about fund differentiation and early-stage investment strategies (and fund resources to support early-stage companies) that mean higher costs and increased risk for VCs. The arbitrage opportunities are getting gobbled up in the States.

This week I want to highlight another emerging trend, one that doesn’t have an official name yet. The article I’ve copied here (from www.readthegeneralist.com) calls it ‘calm funds’. They acknowledge that this investment class has yet to crystallize, but is attracting a good deal of interest in the States. The article is written in collaboration with Tyler Tringas of Earnest Capital, who call themselves a calm fund.

The ‘calm’ refers to what they believe to be a more patient approach to investing (with lessened horizons for returns that are, ideally, less risky bets in the first place). The article does a good job of offering the rationale for calm funds (for both the investor and the start-up) and allied new entrants, including ‘micro-private equity’ and ‘small-business conglomerates’.

Rather than translating, I’ve copied the post here. I’m intrigued, have some questions, and plan to reach out to Ernest Capital to discuss. If you have thoughts or question, pass them on to me so I can update you in posts later this year.

As always, thanks for being there!

The Calm Capitalists

“Funds for bootstrappers” show venture is not the only way

This is a collaboration between The Generalist and Tyler Tringas of Earnest Capital. A disclaimer: I (Mario) am a teeny-tiny LP in Earnest via a recent crowdfund campaign. I think it’s an interesting opportunity, but everyone should do their own diligence.

The point of Hearts is to escape unscathed.

Unlike other card games that reward the player for accumulating points, Hearts is a contest of evasion, circumvention. The player that wins is the one that has the lowest score, having collected few (or no) heart cards.

That is one way to win at Hearts; there is another. The dark twin of traditional play is a strategy referred to as “shooting the moon.” Instead of trying to avoid hearts, shooting the moon requires you to hoard all of them. If you succeed, you receive 0 points for the round, the best possible score.

It’s a captivating strategy in theory, bewitching in its boldness, but it’s almost impossible to pull off. Even if you miss just one heart, you have failed. Instead of finishing with 0 points and glory, you reach the end of the round with 25 points, the game lost.

Shooting the Moon is the ludic equivalent of taking down the Death Star — a low-probability kill shot that requires the threading of a narrow needle.

It’s also a fitting metaphor for building a company with venture capital. Startups funded by VC are asked to generate momentum that attracts more and more money, accumulating points. But executing this strategy that deemphasizes profitability means that even a tiny misstep — the wrong go-to-market, a failed product launch — can scupper the entire endeavor.

There are some good reasons for the popularity of this approach, of course. By their very nature, technological breakthroughs are unlikely, and venture capital’s history is rooted in funding those kinds of businesses. That legacy continues to define entrepreneurial dynamics, even as VCs shift from capitalizing dicey technical bets to a down-the-line B2B SaaS play. The result is that startup founders are asked to adhere to this peculiar, vestigial approach; told that to play Hearts, the only option is to shoot the moon.

A new generation of early-stage investment firms offers an alternative. “Calm funds” (CFs) seek to work with company builders that choose to play a different way. Rather than shooting the moon by pursuing growth at all costs, calm founders look to build sustainable businesses that are “default alive,” meaning they don’t require regular capital injections to stay alive. While some may operate in niche markets that cap their ultimate size, many of these businesses seek to reach the same scale as VC’s biggest winners. Indeed, though they’re not always viewed this way, companies like Github, Atlassian, and Zapier all ran this playbook, taking in limited outside funding, or delaying it. Instead, of trying to gobble up market share unsustainably, these founders chose to secure the existence of their company early in its lifecycle. Other less recognizable calm businesses like Wildbit, Tuple, Papertrail, and VueScan, might approach or surpass unicorn status in a venture paradigm.

The few firms that have planted a flag in this market have seen promising returns that often outshine buzzier venture cousins. And yet, the world of calm funding has struggled to break into the mainstream. Even worse, some of its most vocal exponents, like Bryce Roberts of Indie VC, have had to pack up shop after failing to tempt venture-caffeinated LPs to switch to a milder brew.

It places CF at an intriguing crossroads. Though boasting clear potential, the asset class still feels like it is searching for a distinct identity and concise narrative. To unlock institutional funds, this asset class may need to find a way to package itself. If it can, it has the potential to go mainstream and serve many more businesses than traditional venture.

Here’s where we’re headed:

- Defining “calm funding” and its place in the startup-financing ecosystem.

- The funding mechanisms used by calm investors, through the lens of The Generalist.

- The return profile of leading firms.

- What calm funding needs to do to go mainstream.

What’s in a name?

It is, perhaps, the sign of a thriving, emergent movement to have a healthy disagreement over nomenclature.

What is the right terminology for this new class of investors? We have chosen to go with “calm funding” (and associated derivatives) for its implication of circumspection. Others favor alternatives, including “bootstrapper funds” (an oxymoron?), “indie venture,” “early-stage value investing,” or something else.

Of course, each name does connote something slightly different. “Early-stage value investing” perhaps signifies a quantitative focus, while “bootstrapper funds” might suggest targeting solo founders or small teams.

For the avoidance of doubt, when we refer to a calm fund, here’s what we mean above all: an investment firm that backs companies that do not risk survival for growth. This includes businesses that operate in niche markets that have a capped upside and those with the potential to one day go public.

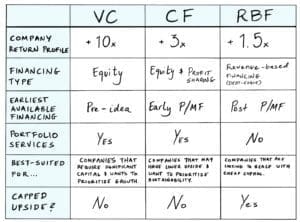

In the types of business they invest in, calm funds seem to sit on a spectrum with both micro private equity (think Tiny Capital), and SMB conglomerates like Constellation Software. CFs take minority stakes in the businesses they back, versus the controlling interests pursued by micro PE. Conglomerates like Constellation take this to the next level by bundling large numbers of niche software businesses.

Despite its positioning in this lineage — the baby brother of one of the greatest compounders of the last quarter-century — there is a paucity of funds pursuing a calm thesis. Earnest Capital, a collaborator on this piece, has publicly planted a flag in the space. Indie VC, discussed below, was another before shutting its doors. This week, Collab Capital, an Atlanta-based firm, announced it had raised $50 million to pursue a dual-VC/CF approach. There are few others.

All of this feels a world away from the noise and lather of traditional venture capital. As discussed in “Power in the Valley,” the last decade has seen the rise of a superabundance of firms. While each fund advertises its complected offering, the asset class shares an unvarying ground truth: venture capital is a grand slam game. Startups’ high kill rate (varyingly reported between 60-90%) necessitates VCs to fund businesses capable of delivering +10x returns. This single winner (if sufficiently large) compensates for the multitude of money losers.

Rather than playing exclusively for home runs, calm funds happily rack up base hits. If VC is all about slugging percentages, calm funding is closer to Moneyball. CFs can make such an approach work by choosing lower-risk businesses and leveraging innovative funding structures that mix ownership with profit sharing.

This latter element spiritually encroaches on the world of revenue-based financing (RBF), though with significant differences. Companies like Pipe, Lighter Capital, Clearbanc, and Capchase offer non-dilutive funding, but this usually operates like traditional debt rather than profit-sharing. These platforms typically require several months of metrics (or more) to provide financing, which means they’re best suited for later-stage businesses.

Over the course of its life, a founder may tap all three, beginning with calm funding as they fortify company foundations, pouring on VC as the opportunity to grab market share emerges, and pulling in revenue-based financing to scale without dilution.

To better understand how CF financing works, let’s work through a familiar example.

SEALing The Generalist

Remember what we said about naming? As much as a rigamarole there is around naming the asset class, there’s a similar skirmish around financing types.

While early-venture has mostly agreed to use Y Combinator’s “Simple Agreement for Future Equity,” or SAFE template, no default yet exists in the world of calm funds. Collab offers the SPACE, Earnest suggests a SEAL, and Indie most recently proposed “v3 Terms.”

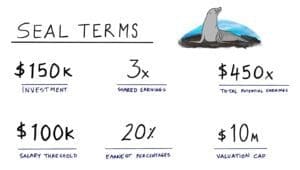

Each has differences in profit-sharing caps, conversion mechanisms, and other intricacies. For the sake of conciseness, we’re going to work off of SEAL.

The “Shared Earnings Agreement,” aka SEAL (the “L” is cosmetic), is a flexible financing mechanism that aligns incentives between founders and investors, regardless of whether the company pursues sustainable profitability or hyper-growth. It can toggle from one to the other.

At its core, the SEAL takes a capped percentage of “founder earnings” above a certain threshold. The idea is that once a founder begins to take a dividend above a mutually agreed-upon threshold, a portion of that amount goes toward the total shared earnings cap.

If a founder switches modes and decides to raise venture capital, the SEAL transitions into an equity agreement. The remaining portion of the total shared earnings cap is converted into an ownership stake.

This is jargony stuff. To make it a little easier (and hopefully more interesting), let’s walk through things using The Generalist as an example. Since I always like to be as transparent as possible with my numbers, the figures I cite are real, though I’ve rounded them to stay clear of the weeds. If you want to play around with the numbers and stress test my assumptions, you can find my fork of Earnest’s SEAL Calculator here.

Ok, here we go. (Cue: wavy visuals and harp strings as we enter this thought experiment.)

Base case

The Generalist decides to raise money. Instead of raising VC, Mario decides to look for calm funds. He finds Earnest and Tyler Tringas and negotiates a deal.

The terms of the SEAL are that The Generalist will receive a $150,000 investment with a 3x “shared earnings cap.” At most, The Generalist will pay off $450,000 to Earnest except in the case of a sale or subsequent venture round. To ensure flexibility, Mario and Tyler agree to a valuation cap of $10 million in case either scenario occurs. This will matter later.

The two esteemed gentlemen also agree to a “salary threshold” of $100,000, meaning that until Mario chooses to pay himself (or take a dividend) above that amount, Earnest will not receive repayment towards the shared earnings cap. Once Mario takes a salary above that point, Earnest will take 20% of the surplus.

Make sense so far?

Ok. So, how long will it take for The Generalist to pay off this cap? It depends, of course, on the speed at which revenue and costs scale.

At the moment, The Generalist is running at an MRR of $11,000 with costs of roughly $2,500 a month. (This doesn’t include a salary for me; I am fortunate to have savings to draw from.) Assuming no further growth, by the end of Year 1, The Generalist would earn $132,000 with costs of $30,000. This results in a dividend of $102,000, just above the $100,000 threshold decided on by Mario and Tyler.

Since Earnest takes 20% of dividends above that threshold, The Generalist will pay off $400 towards the earnings cap in Year 1. (Note: Mario wouldn’t have to take this money as a “salary.” Owners can reinvest as they like.)

Insane as it might seem, I think it is possible that within a year, The Generalist grows revenue 4x. In that scenario, the founder dividend would be significantly larger, and subsequently, Earnest’s stake would reach $64,000. If The Generalist maintained the trajectory I hope we do, Earnest would receive its entire $450,000 by Year 4.

Unlike VC firms that make their money once a company exits, Earnest has locked in a solid 3x return even if Mario never sells The Generalist. Solid stuff.

Acquisition

Time for another scenario.

After running The Generalist for ten years, Mario decides it’s time for a new chapter. Not because he wants to stop, but because over the previous 12 months, he’s started playing a ton of high-stakes Hearts and has gotten into a bad place with some worse people.

To finance life on the lam, he agrees to sell The Generalist for 5x net income. Since The Generalist has continued to scale, that adds up to a pretty nifty $119 million. Enough for a new identity and a fresh start in Belize. (Forget I said that.)

At this point, the SEAL reawakens from its slumber. Whichever is greater between the remaining earnings cap of $450,000 and the initial investment of $150,000 converts into equity at the $10 million valuation set initially. Since The Generalist has already paid off the 3x cap, the $150,000 converts to a stake of 1.5%. That means that Earnest realizes $1.8 million from the sale of The Generalist.

All in, Earnest earns $2.25 million from a $150,000 initial investment in The Generalist, producing a venture-like 15x return.

Venture, then acquisition

One final throw of Destiny’s Dice.

Eighteen months after raising money from Earnest, Mario decides it’s time to fire up the warp drive with the help of venture funding. Since The Generalist has paid almost nothing toward the earnings cap (you’ll remember that Year 1 yielded just $400 for Earnest), nearly the entire $450,000 converts into equity. That gives Earnest a 4.5% stake in The Generalist — locking in a 3x paper return.

Now, imagine that for the next eight and half years, The Generalist keeps growing with no further funding. At Year 10, the company sells for the same price of $119 million. Earnest’s 4.5% return is now worth $5.4 million, a 35x return.

Trade-offs

From the investor’s standpoint, SEAL’s allure is unmistakable. Not only does it translate into equity in the case of a liquidity event, giving access to venture-style upside, the profit-sharing mechanism means returns can be harvested faster, without needing an exit. Calm capitalists essentially get to lock in solid returns as soon as their portfolio company reaches real profitability while also getting a piece of future upside.

Do entrepreneurs receive similar benefits? The truthful answer is, it depends.

If an entrepreneur knows they want to build a venture-scale business, VC money is cheaper. Since a SEAL can convert into equity at 3x the initial investment, founders give up a considerably larger stake than if they’d raised via a traditional convertible note.

If The Generalist raised $150,000 on a SAFE at a $10 million valuation, the SAFE investor would hold a 1.88% stake at the Series A, compared to the 4.50% Earnest received. Going with venture money, in that case, would leave Mario with 91.5% of the business compared to 89% via Earnest.

That might make the SEAL sound like a raw deal. But the magic of calm funding comes from its flexibility and the type of businesses it can support.

Many may embark on their founding journey unsure whether they want to build a venture-scale business or something more modest. Bringing that muted narrative to Sand Hill Road would be an act of masochism — VCs do not want to fund businesses with such humble aspirations. Historically, these company builders have to resort to scaling slowly or raising from friends and family.

Calm funds offer an excellent alternative, providing the services of a professional investment manager alongside the funding needed to get up and running. And whatever approach the company decides upon — massive scale or steady profitability — the SEAL helps maintain strong alignment. Investors do not need to push for a premature sale, nor do they earn-out and lose interest. It is a win/win robust enough to adapt to differing circumstances.

By engineering itself this way, mechanisms like the SEAL have the potential to be radical. Not only do they give founders’ optionality, but they can serve a swathe of startups locked out by traditional capital channels.

Again, let’s return to the example of The Generalist. As mentioned, I am fortunate to have had the financial latitude to earn no salary when I went full-time on this endeavor. Let’s imagine I did not.

What would my options have been?

- Keep working on it on the side until I supported myself.

- Try and raise venture money.

- Raise calm capital.

Option #1 is the default. Though feasible, it would have delayed The Generalist’s growth and perhaps meaningfully altered the company’s trajectory.

Option #2 would have been a challenge. Though today, I am convinced The Generalist can become a big business, I was much less so early on. Unless I spun a narrative I did not believe — costing my integrity — I think it’s improbable I would have secured capital from these partners. VCs have traditionally eschewed media investments, and a newsletter doesn’t scream “fund returner.”

If I did secure a venture partner by some minor miracle, the next few years might have involved a great deal of mutual frustration. My VC backer would likely push for faster, less sustainable growth, while I might have preferred a more conservative approach.

Option #3 would have been the best fit. Calm capitalists wouldn’t have disqualified me based on uncertainty over the size of the opportunity or my lack of desire to sell the company down the line. Just as importantly, a calm fund like Earnest or Collab would provide tactical advice on building businesses within a more sustainable paradigm and wouldn’t feel the need to push for a riskier approach. In sum, CFs would have given me the financial latitude to go full-time on The Generalist, at a stage when VCs likely wouldn’t have.

Companies pursuing hyper-growth should use VC. Everyone else should take a calmer approach.

Indie funding, blockbuster returns

It’s too early to make any definitive claims on the return profile of calm funding. With just a handful of firms in operation, most for just a few years, data is effectively anecdotal.

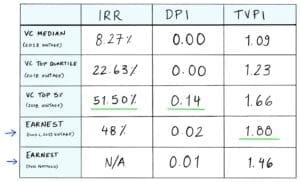

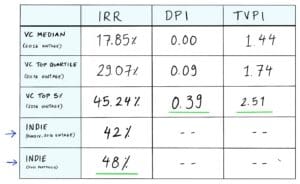

With that caveat, initial indications suggest an attractive return profile compared to venture capital. Though there’s nuance in evaluating performance, we will stick with a few tried-and-true metrics. Namely, IRR (“Internal Rate of Return”, an annualized return rate), DPI (“Distributions to Paid-In”, the amount returned to investors divided by the amount invested), and TVPI (“Total Value to Paid-in Capital,” the estimated value of an investment divided by the amount invested).

In comparing Earnest Capital and Indie VC to venture benchmarks, we have had to show some flexibility. We do not have complete metrics for Indie, and the recency of most of Earnest’s investing makes figures like total fund IRR unusable. Though we are using Cambridge Associate’s most recent publicly available figures, vintages don’t quite line up in Earnest’s case. Finally, since calm investments often don’t raise follow-on capital, holdings of both Earnest and Indie are “as converted.” That means that each fund manager estimates a portfolio company’s valuation rather than relying on the price set in the previous round of funding. This is somewhat arbitrary, though probably no less accurate than the chimerical machinations of venture valuations.

Let’s look at Earnest first:

Data from Cambridge Associates and Earnest Capital

Though referring to DPI so early in a fund’s life always feels vaguely silly, both IRR and TVPI give us a good sense of where Earnest currently sits. By that first measure, Fund 1 is tracking just below the top 5% of similar vintage venture firms; TVPI sits comfortable above the benchmark. The entire Earnest portfolio has already exceeded the top quartile threshold for 2018 funds’ TVPI, despite a slew of newer investments.

Indie VC seemingly boasted similarly strong numbers, though our data is incomplete. Comparing the fund to 2016 vintage VCs give a good sense of performance.

Data from Cambridge Associates and Indie VC

Again, the calm capitalist far outperforms the field. Indie’s entire portfolio IRR of 48% sits in the top 5% of 2016 funds, while Fund IV comes in a whisper below.

And yet, despite driving better returns than almost all of its peers, Indie closed its doors in 2021. Its demise gets at the heart of one of calm funding’s biggest challenges.

In search of definition, proof, and scale

Today’s calm funds give off the impression of slightly scruffy outsiders, rogue contrarians challenging an accepted truth. In that respect, they bear more than a passing resemblance to the early practitioners of venture capital — investors that, to the old guard, looked like loose-handed speculators chasing gains in the mystical, scarcely comprehensible worlds of semiconductors and computers.

Though there is still some of that sparky spirit in venture, it has attained the satisfied gleam of the establishment. If CF is to achieve similar security and ubiquity, it will need to complete three fundamental tasks:

- Make itself legible to LPs

- Prove its value proposition

- Find ways to scale

If successful, CF may, in time, surpass even the asset class it is so often compared to.

Legibility

We are out. The shift in strategy for the fund over time (for your good, intentional reasons) has moved further away from the kinds of companies we are looking to have exposure to.

In his post, “The End of Indie,” manager Bryce Roberts shared this LP email, described as one of “many.” Unable to attract sufficient interest from LPs, Roberts was forced to shut down the Indie strategy.

The problem was, in part, one of communication. As alluded to earlier, calm funding does not agree upon a name, let alone an accepted definition. Variations in companies funded, financing mechanisms, caps, and conversions muddy the water, making it difficult for LPs to rationalize an investment.

This sounds like an almost facile impediment, but that’s far from the case. As Balaji Srinivasan noted in a recent interview, “If code scripts machines, media scripts human beings.” As things stand, calm funding doesn’t have the “media” — the words — that capture and propagate its meaning. For the asset class to truly take off, it will need not just one or two interpreters but a web of collaborators, building a shared language and culture that can be exported and sold.

In time, this may persuade institutional portfolio managers that calm funding is not simply “small VC” but a package unto itself, an asset class that merits attention and allocation.

Proof

The figures shared in the section above indicate that Earnest and Indie succeeded in producing admirable early returns. At this juncture though, it’s hard to know just how seriously this outperformance should be taken.

Two firms allocating less than $100 million in capital over five years do not prove an asset class’s viability. As with most early-stage investment firms, underlying portfolio companies have high variability, with the potential for further breakout performance or total breakdown. Though theoretically, CFs should be better isolated against this volatility given their focus on more sustainable businesses, the risk remains.

Equally, it could be argued that as the asset class’s pioneers, Earnest and Indie had their pick of sub-venture businesses or builders that prioritize a steadier approach.

If CF is to take off, it will need to attract more fund managers and produce returns over an extended period. Indie’s closure is particularly saddening in this respect. Rather than bringing new firms into the fold, CF lost a major exponent and key proof point. Advocates of the movement will hope that Earnest continues to drive strong returns, encourage new participants, and show durability.

Scale

Should CF manage to solve points 1 and 2, it may face the kind of “champagne problem” that would make VC jealous: scaling.

By its very nature, VC is focused on a tiny portion of the corporate universe: primarily tech companies with the potential to drive multi-billion dollar returns. Since that tends to be a rather limited field, most VCs have succeeded in growing AUM without automation. Certainly, the best firms use data and some degree of mechanization. But decision-making remains fundamentally human-driven.

CF has the potential to underwrite a much larger number of companies. Rather than focusing only on those that might produce +10x returns, calm funds can serve companies from 2-3x up. If VCs invested in a reported +10,000 US companies in 2019, how many might CF have backed? 100,000? 1 million?

Given the focus on early financial traction, CF may be able to automate its decisions better. While a purely mechanized approach may not be optimal, it’s possible to imagine a world in which thousands of companies are screened automatically before being presented to distributed portfolio managers for final review.

In such a scenario, CF might begin to look less like a VC alternative and more like small business lending. For comparison, US VCs deployed $136.5 billion in 2019; banks distributed $644 billion in SMB loans.

When I think of Zapier, I can’t help but remember the scene in the social network when Sean Parker’s character says to Mark Zuckerberg: “A million dollars isn’t cool. You know what’s cool? A billion dollars.”

In March of this year, the no-code automation platform’s founders reportedly sold secondary shares to Sequoia at a valuation of $5 billion. Founded a decade earlier, Zapier had operated profitably for most of its life, steadily expanding to $140 million ARR with just $1.3 million in capital raised.

Though many might not have realized it, the company had operated as a fundamentally calm business. Rather than trying to shoot the moon and risk implosion, Zapier ensured control of its fate by building a sustainable, durable business. In the process, the company’s founders avoided dilution, giving them the ability to take some of their stake off the table at a high valuation. They played the game of Hearts, hand by hand.

And so I think of Sean Parker, again:

“Raising money from Sequoia isn’t cool. You know what’s cool? Selling Sequoia secondaries.”

In time, raising and building calmly may become the true status symbol.

Bob Rosenberg

Educator (Associate Professor) / Entrepreneur / Leader of angel

communities /Entrepreneur in residence at PorterShed

and BioExcel / Rarosenberg@gmail.com